How to Start an NDIS Business (Registered & Unregistered Pathways)

Step-by-step guide to starting your NDIS business. Learn registration requirements, provider setup steps, and how to become an unregistered provider.

Steps to Start Your NDIS Business (Complete Guide for Providers)

Introduction

If you’ve ever considered launching a business that makes a genuine difference in people’s lives, now is the perfect time to step into the National Disability Insurance Scheme (NDIS) space. With the demand for quality disability support continuing to grow across Australia, starting an NDIS business offers not only personal satisfaction but also long-term sustainability.

Becoming a registered NDIS provider gives your business increased trust and visibility, making it easier to connect with participants and secure referrals. Registration also ensures you’re eligible to work with all types of NDIS participants, including those managed by the NDIA(National Disability Insurance Agency).

This guide outlines everything you need to know from setting up your business to completing your registration, so you can launch with confidence.

What is an NDIS Business?

An NDIS business is any organisation or individual that delivers support services funded by the National Disability Insurance Scheme (NDIS). These services help people with permanent and significant disabilities achieve greater independence, community participation, and overall well-being.

NDIS businesses can be small sole traders providing in-home care, or large multidisciplinary organisations offering a wide range of support. What they all have in common is a focus on empowering NDIS participants - people who are eligible to receive NDIS funding to lead more fulfilling lives.

An NDIS business is a provider of support services funded under the National Disability Insurance Scheme. These services can include:

1. Assistance with Daily Life: This includes support with personal care tasks like bathing, eating, and grooming, as well as support with household tasks like cleaning and meal preparation.

2. Transport: Individuals who need assistance with transportation to access supports, work, education, or community activities may receive funding for transport. This can include specialized transport, taxis, or support for using public transport.

3. Social and Community Participation: The NDIS supports individuals to participate in social and community activities, fostering connections and reducing social isolation.

4. Assistive Technology: This category includes funding for equipment, devices, or technology that helps individuals with disabilities perform daily tasks and increase their independence. Examples include wheelchairs, communication devices, or specialized kitchen equipment.

5. Home Modifications: The NDIS can fund modifications to a participant's home to make it more accessible and suitable for their needs.

6. Support Coordination: This involves assistance with navigating the NDIS system, developing and implementing support plans, and connecting with relevant service providers.

7. Improved Living Arrangements: The NDIS can help participants find and maintain suitable housing, including supported independent living options.

8. Other Supports: The NDIS also funds a range of other supports, such as:

- Consumables: Everyday items like continence products or wound care supplies.

- Finding and Keeping a Job: Support to help participants find and maintain employment.

- Improved Relationships: Support to improve social skills and build relationships.

- Improved Health and Well-being: Supports that focus on improving functional ability and long-term recovery, like psychology or occupational therapy.

- Improved Learning: Supports to assist with education and skill development.

- Improved Life Choices: Supports to help participants make informed decisions about their lives and goals.

NDIS businesses can be run by individuals, small teams, or large organisations. They operate under various legal structures including sole traders, partnerships, companies, not-for-profits, or charities.

Getting Your NDIS Business Ready

Before registering with the NDIS Quality and Safeguards Commission, you need to set your business up correctly. Here are the key steps:

Choose Your Service Focus

Decide on the services you will provide. This could range from personal care to allied health, housing support, or transport. Choose an area you're passionate about and confirm demand through market research.

Name Your Business

Select a business name that is unique, easy to remember, and reflective of your services or values. Check its availability through ASIC’s business name search tool and register it officially.

Create a Business Plan

Develop a business plan that outlines your:

- Service offering

- Market and competition

- Target customer (NDIS participants)

- Financial forecast

- Marketing strategy

Building a business plan also means understanding your financial commitments from the start. You can explore a detailed breakdown of the cost to start an NDIS business to budget realistically and avoid surprises later.

Pick a Business Structure

Your business structure impacts tax, liability, and compliance. Choose from:

- Sole Trader: Simple setup with full control but full personal liability.

- Partnership: Shared ownership and responsibility between two or more people.

- Company: A separate legal entity offering limited liability but greater compliance.

- Not-for-Profit or Charity: Mission-driven organisations that may be eligible for tax exemptions and grants via the Australian Charities and Not-for-profits Commission (ACNC).

Building a business plan also means understanding your financial commitments from the start. You can explore a detailed breakdown of the cost to start an NDIS business to budget realistically and avoid surprises later.

Register Your Business

Make sure your business is legally recognised by:

- Applying for an Australian Business Number (ABN).

- Registering your business name via ASIC.

- Understanding your tax obligations through the ATO.

- Applying for any relevant local permits or licences.

Registered vs Unregistered NDIS Business: What’s the Difference?

When starting your own NDIS business, one of the first decisions you’ll make is whether to register with the NDIS Quality and Safeguards Commission or operate as an unregistered provider.

Both options allow you to deliver supports under the NDIS, but they differ in terms of compliance, clients, and growth potential.

Registered NDIS Provider

A registered provider is approved by the NDIS Commission to deliver funded supports to participants whose plans are NDIS-managed (by the NDIA).

Becoming registered demonstrates that your business meets strict quality, safety, and compliance standards.

Key features:

- Must undergo an audit against the NDIS Practice Standards

- Eligible to work with NDIS-managed, plan-managed, and self-managed participants

- Must meet ongoing compliance, reporting, and renewal requirements

- Builds stronger credibility and trust with participants and referrers

- It may take longer and cost more to set up

Best for:

Businesses aiming to scale, offer clinical or high-risk supports, or work directly with NDIS-managed clients.

Unregistered NDIS Provider

An unregistered provider does not need NDIS Commission approval to operate.

You can start faster and with fewer compliance costs but your client base is limited.

Key features:

- Can only work with self-managed and plan-managed participants

- No mandatory audits or registration fees

- Easier to start as a small business or sole trader

- Must still meet NDIS Code of Conduct and Australian business laws

- Cannot provide support to NDIA-managed participants

Best for:

New providers wanting to start small, gain experience, or test the NDIS market before pursuing registration.

Which Option Is Right for You?

If you’re looking for flexibility and a low-cost entry, starting as an unregistered provider may suit you.

If you’re building a long-term, scalable NDIS business that serves all participant types, becoming a registered provider is the better path.

Learn more about the step-by-step process in our detailed guide: How to Become an Unregistered NDIS Provider

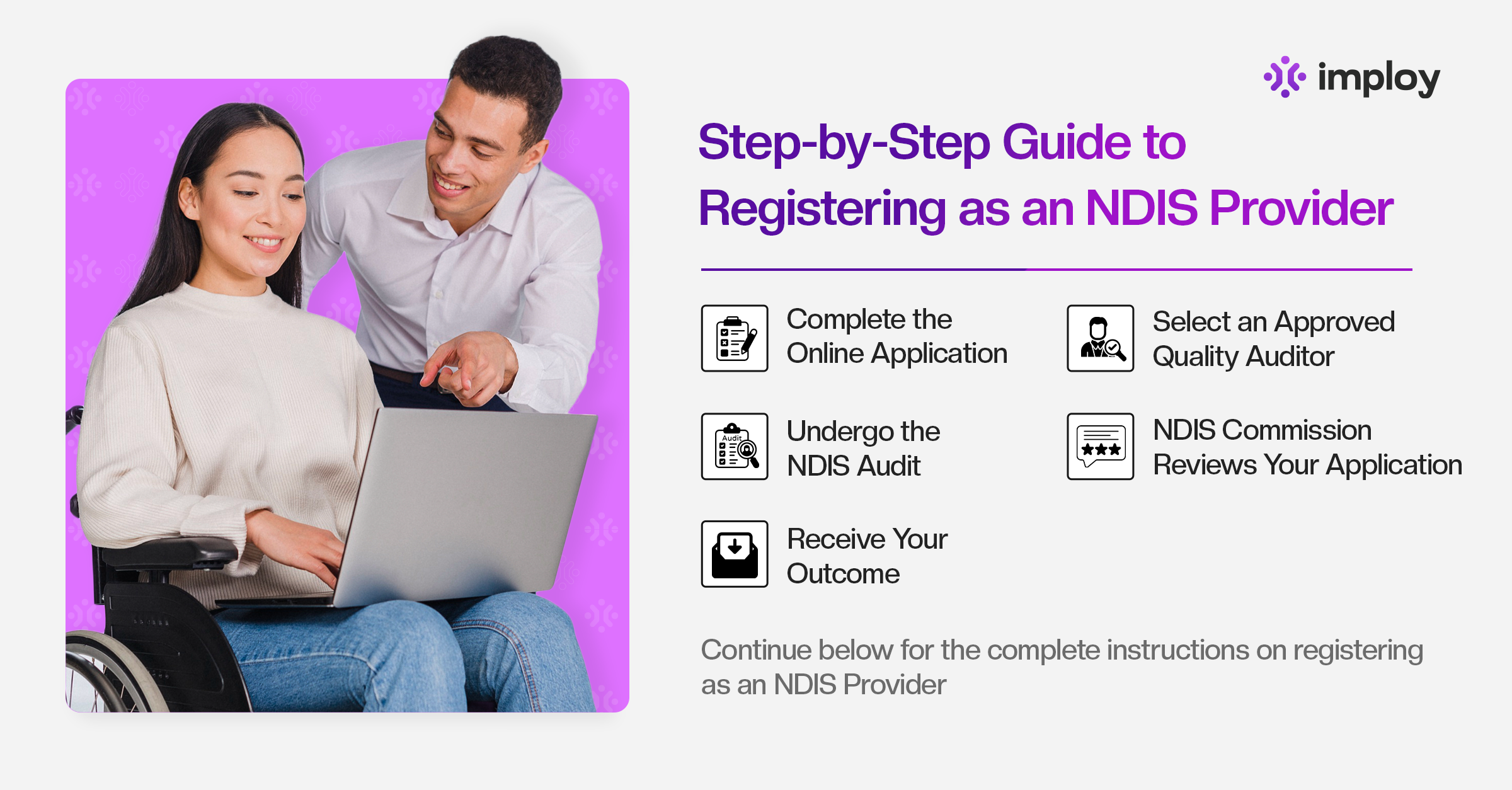

Step-by-Step: How to Register as an NDIS Provider

Step 1: Complete the Online Application

Start your registration at the NDIS Commission Provider Application Portal. You’ll need:

- Your business structure and contact details.

- A list of the services you plan to offer.

- Information about your business outlets and key personnel.

- To choose the correct registration groups.

- To complete the NDIS Self-Assessment against the NDIS Practice Standards.

You have 60 days to complete your application once you begin.

Step 2: Select an Approved Quality Auditor

After submitting your application, you’ll receive an Initial Scope of Audit. Based on your services, you’ll need either a:

- Verification Auditor - for low-risk services like cleaning, transport.

- Certification Auditor - for higher-risk services like behaviour support.

Choose from the list of NDIS-approved auditors. Note that once you submit your application, you cannot change the details.

Step 3: Undergo the NDIS Audit

The audit confirms your capability to deliver services safely and professionally.

- Verification Audit: A desktop audit suitable for sole traders or simple support services.

- Certification Audit: A comprehensive review for complex or high-risk services.

Audit costs vary depending on service type and business size.

Step 4: NDIS Commission Reviews Your Application

The NDIS Commission assesses:

- Your audit results.

- The suitability of your organisation and its key personnel.

Suitability checks may include criminal history, past compliance issues, and operational history.

Step 5: Receive Your Outcome

If your application is successful:

- You’ll be issued a Certificate of Registration.

- You’ll receive details about your registration terms, conditions, and renewal.

If unsuccessful:

- You can request a review within 3 months.

- You may lodge an appeal through the Administrative Appeals Tribunal (AAT).

Approval can take up to 12 months, with an average turnaround of about 6 months.

Can You Operate While Waiting for Approval?

Yes! You’re allowed to deliver services to:

- Self-Managed Participants: These individuals manage their own NDIS funding. They can choose and pay any provider—even if the provider is not officially registered with the NDIS Commission. This offers greater flexibility for both the participant and the provider.

- Plan-Managed Participants: These participants use a registered plan manager to handle their NDIS funds. Like self-managed participants, they can also engage unregistered providers, as long as the service is aligned with their NDIS plan.

However, you cannot work with NDIA-managed participants. These participants have their funds managed directly by the National Disability Insurance Agency (NDIA). They can only use providers that are officially registered with the NDIS Commission.

Market and Brand Your NDIS Business

Once you’re ready to launch, make sure your business is visible and trustworthy:

- Build a professional website that showcases your services and values.

- Develop a strong brand identity - logo, colours, and messaging.

- Launch a marketing plan including SEO, local directories, and print.

- Use social media platforms to connect with local communities.

- Collect testimonials and reviews from satisfied participants and families.

How to Minimize Operating/Admin Cost?

Managing admin tasks like invoicing, compliance, and documentation can take a toll on your time and resources. To keep costs down and stay focused on care delivery, it’s important to streamline operations.

For sole traders and small teams, managing admin with limited resources can be particularly challenging. That’s why many new providers benefit from using NDIS software for small-scale providers. These platforms are built to simplify compliance, invoicing, documentation, and rostering without the complexity or cost of enterprise-level systems.

Here’s how you can minimise admin and operational overhead:

1. Streamline Admin Tasks

Automate paperwork and compliance tracking to save time, reduce errors, and focus more on care delivery.

2. Reduce Staff Turnover

Invest in staff training, incentives, and positive culture to cut down on recruitment and onboarding costs.

3. Use Efficient Scheduling Tools

Adopt rostering software to avoid double-booking, minimise downtime, and optimise staff allocation.

4. Invest in Quality Equipment

Buy durable, high-quality tools and software to reduce long-term maintenance and replacement costs.

5. Leverage Technology

Automate tasks like invoicing, claims, and reporting with platforms like imploy healthcare to save time and reduce staffing needs. Many of these tools are now adopting AI features, transforming care management in Australia, giving providers smarter ways to predict needs, improve compliance, and cut down on manual admin.

6. Monitor Budgets in Real-Time

Use live tracking tools to stay on top of NDIS plan usage and avoid overspending or under-delivering.

7. Submit Bulk Claims via PRODA

Reduce claim time and manual uploading by using tools like imploy that support bulk submissions.

How imploy Can Help You Reduce Admin Costs?

imploy, a leading all-in-one NDIS care management platform, is built to take the pressure off providers by automating and simplifying everyday admin tasks. Here's how it saves you time and money:

- Automated Invoice Generation

imploy creates accurate invoices from completed shifts, travel logs, and support notes; no manual entry or spreadsheets needed. Learn more in the NDIS Invoicing Guide. - Real-Time NDIA Pricing Updates

Never worry about using outdated prices. imploy syncs with the latest NDIA pricing guide, helping ensure all claims are correctly priced and compliant. For providers managing both finance and rostering, dedicated NDIS plan management software can integrate seamlessly, helping you streamline claims and participant budget tracking.

- Bulk Claim Submissions via PRODA

Submit multiple invoices in bulk with direct PRODA integration. This speeds up processing, reduces errors, and improves your cash flow. - Live Funding Visibility

imploy shows real-time insights into participant budgets, helping you plan services, avoid overspending, and reduce rejected claims. - Paperless Workflows

Say goodbye to printed shift logs and filing cabinets. imploy digitises everything - logs, notes, invoices, so your team can work smarter, not harder.

To improve documentation further, you can also check out imploy’s SOAP Notes Guide, which helps staff take consistent, compliant progress notes with ease.

For audit readiness and compliance, the NDIS Audit Guide can help you stay ahead without extra admin burden.

Conclusion

Starting your own NDIS business is a powerful way to make a real difference in people’s lives while building a rewarding and sustainable career. From planning your services to registering with the NDIS Commission, the journey requires clear direction, compliance, and commitment.

But running a successful NDIS business isn’t just about great service delivery, it’s also about staying efficient behind the scenes. Tools like imploy can help you reduce admin workload, avoid costly errors, and stay focused on what matters most: your participants.

With the right setup, smart systems, and ongoing support, you can grow a thriving NDIS business that’s both impactful and financially sustainable.

FAQs

1. How long does the NDIS registration process take?

The full registration process can take up to 12 months, depending on the complexity of your application and the audit process. On average, most applications are processed within 6 months.

2. What qualifications do I need to start an NDIS business?

It depends on the services you plan to offer. Some supports (like allied health or behaviour support) require formal qualifications and professional registration. Others, like domestic assistance or transport, may not require formal qualifications but do need relevant experience, screening checks, and training.

3. Do I need insurance to run an NDIS business?

Yes. All NDIS providers—registered or unregistered—should have appropriate insurance. This usually includes public liability, professional indemnity, and workers compensation if you employ staff.

4. What is the difference between verification and certification audits?

- Verification audits apply to low-risk services (e.g., domestic support, transport).

- Certification audits are required for higher-risk services (e.g., behaviour support, complex health care).

The type of audit required depends on the registration groups you select.

5. Do I need to be registered to start providing NDIS services?

No, you can start providing services to self-managed and plan-managed participants without being a registered NDIS provider. However, to work with NDIA-managed (agency-managed) participants, registration with the NDIS Commission is mandatory.